Keynote Address, 2010 Islamic Finance Conference, Rendezvous Hotel, Melbourne

"Islamic Finance providers can structure financing in such a way to overcome this barrier, opening up financial and housing choices that would otherwise isolate Muslims from the rest of the population." Only four R-ADIs have been granted, and one licence has already been handed back after the institution, Xinja, failed and had return all of its customers' money. A R-ADI is a transitional banking licence that APRA introduced a few years ago to allow smaller operators to enter the market. Now two small local entities are trying to have another crack at setting up an Islamic bank in Australia using a new form of banking licence set up by the financial regulator, APRA. "So a lot of these investors, as the industry has developed, will be looking to diversify their funds and look for alternative investment location. Australia is well placed in all of that."

Even during these challenging times their team are willing to help. We have now provided more than $300 million of Islamic finance to customers nationally and our presence has grown across Australia with representatives in each state. Our Low Doc products may be the perfect solution for self-employed business owners who do not have the standard financials.

Interest is everywhere – it's tied to home loans, deposit accounts, credit cards, and is meticulously manipulated by our own central bank. If you are going to make an offer at a private sale please ensure your lawyer requests a “subject to finance” period. Ultimately, we want to bring our Shariah compliant products to the grass roots of our community and we have leading representatives in each state that can assist you. We have been recognised for our commitment to client service having been awarded the Best Islamic Finance Institution for three consecutive years by the prestigious. The Islamic Finance News awards honour the best in the Islamic finance industry and are one of the most prestigious awards highly recognised by global Islamic finance capital markets. If you're buying your first home, an investment property or if you want to change your current home loan to a Shariah compliant option we can help.

Our experienced consultants can help your business reach new heights by offering Ijarah lease agreements to enable your business to acquire or lease assets such as motor vehicles, trucks, plant equipment, machinery & more. Find out the latest insights about Islamic finance and investments. Be part of a 4000+ member strong community that finances projects and ambitions through Islamic contracts. Find out the latest insights about super, finance and investments. We congratulate you for making the right choice and selecting the halal home loan alternative. Once you have completed and submitted this form, a dedicated MCCA sales executive will contact you within 1 business day to walk you through the next stage of your application.

The product uses a similar arrangement to the Islamic home loans, with a combination of rental arrangements and fees. Its new Sharia-compliant financing product specifically targets transactions over $5 million for commercial property and construction. Yet, despite making an Australian gastronomic icon, over the years the small business owner has felt excluded from the country's financial system and investment opportunities. "One of the reasons why we do not have a house loan is because we've didn't feel that the conventional banking method of getting a house was in line with our values," Zehra says.

Islamic Finance Halal Loans Sharia Finance Australia

Chief operating officer Muzzammil Dhedhy, a qualified cleric and Islamic theologian, says Islamic laws govern all aspects of Muslims’ lives and many will not feel comfortable dealing with a conventional bank. To date, Victoria is the only state to recognise the potential for Islamic finance contracts to incur double stamp duty, introducing legislative exemptions in 2004. Chief executive Dean Gillespie says the bank already has a customer waiting list of 5000 and hopes to open next year.

However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs.

If you encounter an error, please come back shortly and try again. This course provides a high-level insight into the architecture of Islamic finance. Current CSU students can view Subject Outlines for recent sessions.

Traditional term deposits in Australia are a secure type of investment that earns you interest over a period of time. The typical Australian home loan earns a certain amount of interest annually. That interest is the profit the financial institution makes when you borrow its money. Binah who specialise in delivering full scale construction services have utilised NAB’s new Islamic financing product on their latest development. Another financing company, Hejaz Financial Services, which is already in the home loan and superannuation space, says it has also just started the process of applying for a R-ADI. A R-ADI is a transitional banking licence that APRA introduced a few years ago to allow smaller operators to enter the market.

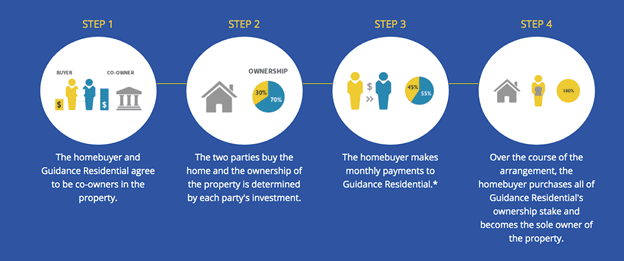

It’ll have no account keeping fees, and you can withdraw and deposit money using ATMs available in Australia. According to Islamic Bank Australia, rent is only charged on the proportion of the property you don’t own. This means your rent should go down over time, and eventually you’ll have full ownership of the house. To follow Sharia Law, Islamic Bank Australia will follow a lease-to-buy/co-ownership model that acts like paying a monthly rent until you pay off the equivalent of the property’s original price. There are hundreds of deposit-taking banks around the world that are Sharia-compliant.

You agree to categorise content only under those categories that are relevant to the content. In general, we advise attempts to categorise content under more than five categories will lead to that content being reviewed and possibly removed. You acknowledge that we reserve the right to edit release's tags to ensure your release is sent only to relevant people. We have already started this journey by planting trees and fighting homelessness.

This is where the Islamic financier buys the house for the client and then rents it to them over a fixed term, generally decades. One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim. "The customer is at risk and the bank is at risk, and in order to achieve that it's not a debt relationship, it's more like a partnership relationship," Asad Ansari says.

Australias 1st Islamic bank will distribute through brokers

“Looking to get secure sharia-compliant finance is quite hard,” Mr Karolia said. Chief operating officer Muzzammil Dhedhy, a qualified cleric and Islamic theologian, says Islamic laws govern all aspects of Muslims’ lives and many will not feel comfortable dealing with a conventional bank. Chief executive Dean Gillespie says the bank already has a customer waiting list of 5000 and hopes to open next year.

Generally, it’s not possible in Australia to provide a fixed rental for the entire term of a mortgage. Melbourne-based investment advisory firm Hejaz Financial Services has also applied for a banking licence after seeing huge demand for its sharia-compliant finance, mortgages and superannuation since 2013. And at least two entities are seeking a licence to establish Islamic banks in Australia, alongside non-bank financial institutions that already offer sharia-compliant services. Islamic Bank Australia (islamicbank.au) will be the first Australian bank to offer a full suite of retail and business banking services – all without interest and Shariah-compliant for the first time in Australia.

He recently acquired a car, but to avoid buying it through finance, ended up leasing it, which was more expensive and meant he didn’t actually own the vehicle. To get into the housing market, he sees little alternative to a conventional mortgage. Among both Muslim and non-Muslim Australians the proportion of people owning with a mortgage was about 37 per cent, indicating many Muslims are already accessing non-Muslim financing methods. Meanwhile Islamic Banking Australia - a group of Muslim Australians and industry veterans - have applied for a licence for a digital bank that is totally sharia-compliant.

Outside of Australia, Islamic banking is not limited to cooperatives and small businesses. Most recently South Korea and Malta were among those countries expressing strong interest in opening some main branches. "I'm not sure why the mere usage of the world 'interest' can cause a conflict between Sharia and Aussie law," he says. The MCCA has also taken on some of the risk in this transaction, as it essentially has made the purchase on behalf of Tabiaat. According to the MCCA, the mortgage can either be seized by the funder or left with the borrower given that it is registered for full mortgage securities entitlement to the funder.

I live in interstate and I had all the communication with them either over the phone or via email. I faced no difficulty dealing with Insaaf and the financing process was very smooth. And we look forward to provide you personalised and ongoing advice. Dr Imran Lum, Director Islamic Finance in NAB’s Deal Structuring and Execution team said; “We’re really proud to be able to offer such a valuable service to Australia’s Muslim community. On the question of signing up to an Islamic bank with deposit account capabilities, Melbourne couple Melike and Ibrahim had mixed views. "We've done $100 million in loans, just in the past six months," Hejaz's chief executive Hakan Ozyon says.

Designed to meet Islamic Law requirements, the product structures financing as a lease where ‘rent’ and ‘service fee’ are paid instead of ‘interest’. The Bank has also invested in achieving the endorsement of Amanie Advisors, a global Shariah advisory firm on behalf of its customers to provide comfort around the law compliancy while saving clients valuable time and money. Over time, the client pays off the house through rental payments, which include a profit to the financier and reflect market interest rates.

According to Islamic beliefs, using products that earn or pay interest is forbidden because it's viewed as exploitative, unfair and unjust. For example, being charged interest on a small loan that’s needed to meet basic financial needs is considered unethical. The economist and former Liberal Party leader chairs specialist lender Crescent Finance, which is targeting both foreign institutions and local investors to back funds that will lend to Australian Muslims. The National Bank of Australia has already begun on its effort, although it doesn't yet offer any Islamic financing itself yet. Since 2007 it has been offering an annual $25,000 scholarship to allow young Australian Muslims to continue their studies in finance.

Sydney-based startup IBA Group, which is led by Muslim scholars, told ABC News they started the process with APRA to get a R-ADI a few years ago. "The Islamic Finance question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space.

National Australia Bank today announced that it has invoked its disaster relief package for customers impacted by bushfires in the Perth Hills area of Western Australia. This service may include material from Agence France-Presse , APTN, Reuters, AAP, CNN and the BBC World Service which is copyright and cannot be reproduced. "One of the great things about Australia is we live in a nation where so many different people from different cultures or different religious backgrounds, or even no religion at all, can get on."

Why Splend's Flexi own plan is halal car finance

This is due to competitive pricing and a values-driven nature. When it comes to making our community’s dreams come true, MCCA has a strong track record in delivering excellence. Islamic home loans offer a lot of the same features as conventional mortgages, so you still need to compare the deals available to make sure you’re getting the most suitable one for you. Long-term borrowers are paying up to $70,000 more in repayments than first-time customers, according to new figures released Sharia Bank Loans by the broking ... In August last year, NAB launched a range of specialised business finance products geared towards Muslim business owners. Islamic finance is based on a belief that money should not have any value itself, with transactions within an Islamic banking system needing to be compliant with Shariah .

The first dealer then owes the second dealer the amount of money they transferred. It is informal, meaning that arrangements are based on trust and not official contracts. There is a vigorous debate about whetherinsurance is halal or haram. Some Islamic scholars do argue that traditional insurance is permissible because the intentions of insurance are good. But a Muslim can err on the side of caution and focus on cooperative insurance.

We have now provided more than $300 million of Islamic finance to customers nationally and our presence has grown across Australia with representatives in each state. Find out the latest insights about Islamic finance and investments. Get the house you dreamt of with halal financing from ICFAL. Invest your hard-earned money the halal way to own the house and call it home. Our Low Doc products may be the perfect solution for self-employed business owners who do not have the standard financials. Fixed cost development, licensing and hosting fees for the use of financial calculators, key fact sheets and research.

Anyone can apply for an Islamic mortgage and the application is assessed on your financial circumstances, not your religion . You may find your deal more expensive due to the particular nature of Islamic mortgages and the fact that there aren’t many providers. Although you won’t be paying interest, you’ll be paying more than the selling price in the form of your rental or profit fee.

A Muslim financier can give money to a non-Muslim investor, or vice versa. Mudarabah is not an excuse for a Muslim to go around sharia regulations. A seller and buyer participate incost-plus pricing, agreeing on the same cost of an asset.

Our growing community is proof of the respect that both Splend and Halal Car Finance Australia its members have for Islam, and should give you the confidence to be a part of it and start boosting your income. But Dr Choudhury said the biggest demand for Islamic finance is for home loans. "I tell my students that resharing is critical for equitable economic growth in a country. Since the fundamentals of Islamic finance are based on resharing, interest from Western stakeholders is growing," he said. "In my view, there should not be two types of banking in the same bank, you cannot mix haram and halal," he said. Talal Yassine is an experienced business leader, entrepreneur and academic. In an executive capacity and for over two decades, Talal has straddled the worlds of business, finance and law.

Islamic Finance Halal Loans Sharia Finance Australia

Your application is subject to the Provider’s terms, conditions and criteria. Anyone can apply for an Islamic mortgage and the application is assessed on your financial circumstances, not your religion . You may find your deal more expensive due to the particular nature of Islamic mortgages and the fact that there aren’t many providers. Although you won’t be paying interest, you’ll be paying more than the selling price in the form of your rental or profit fee. Find out how much the rate is and what your eventual total repayment amount will be.

One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim. "The customer is at risk and the bank is at risk, and in order to achieve that it's not a debt relationship, it's more like a partnership relationship," Asad Ansari says. But that's been hard to achieve in Australia's mainstream banking system. If you are refinancing, the valuation on the property is ordered immediately after you are granted a Conditional Approval. We will order a valuation of the property once you have provided us with a valid contract of sale.

Dr Tanmoy Choudhury, a lecturer at Edith Cowan University in Perth, said the size of Islamic banking in Australia is at least AUD 2.5 billion. Of course, the concept of Islamic banking is gaining importance in Muslim-majority countries, even in many developed countries in the West, and Dr. Hassan is very optimistic about its future success. "But in the Qur'an, Allah has made business lawful. Interest is forbidden not only in Islam, but in all Abrahamic religions, such as Christianity and Islamic Finance Sydney Judaism," he said. "On the other hand, there is no harm in financial transaction in Islam, but there should be no extra charge. This is what Allah has declared forbidden in the Holy Qur'an." Dr. Mohammad Kabir Hasan, Professor of Finance at the University of New Orleans and Dr. Tonmoy Choudhury, Lecturer at the Edith Cowan University School of Business and Law will discuss how Islamic banking works and its future in Australia.

How your loan to value ratio affects the amount you can borrow and how much your subsequent payments will be. Even with an Islamic mortgage, if you Halal Loans have less than a 20 per cent deposit, you’ll have to pay Lender’s Mortgage Insurance . Your lender owns the security over the property, so if you stop paying the mortgage, the lender can force the sale of the property to recoup the outstanding money. Once you’ve made your final rental or lease payment, the institution transfers ownership of the property to you as a promissory gift, or hiba. Construction company Binah said the NAB’s sharia-compliant finance meant it could take on projects with development partners and fund them while maintaining core values of their faith. Our shariah-compliant financing solutions are here to help you to meet your property, vehicle or commercial need.

For information on how we've selected these "Sponsored" and "Featured" products click here. You might want to pay fortnightly or even weekly, so make sure that your institution will let you do this. You can, once the terms are laid out clearly, both take on the risk of the agreement. When you take an Islamic home loan, you’ll be using a product that’s devised with several principles in mind.

The commission depends on the amount of the finance, cost of the product